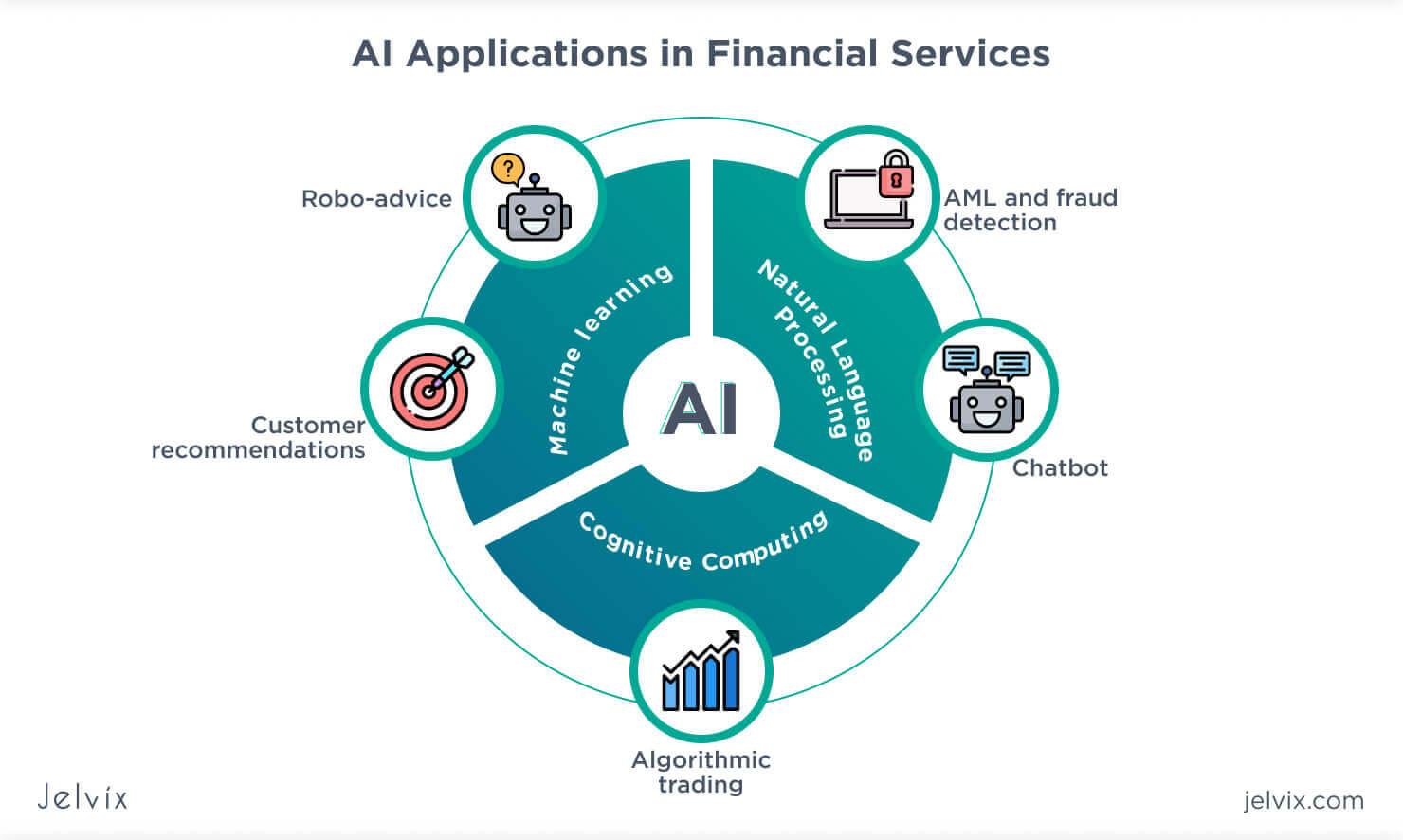

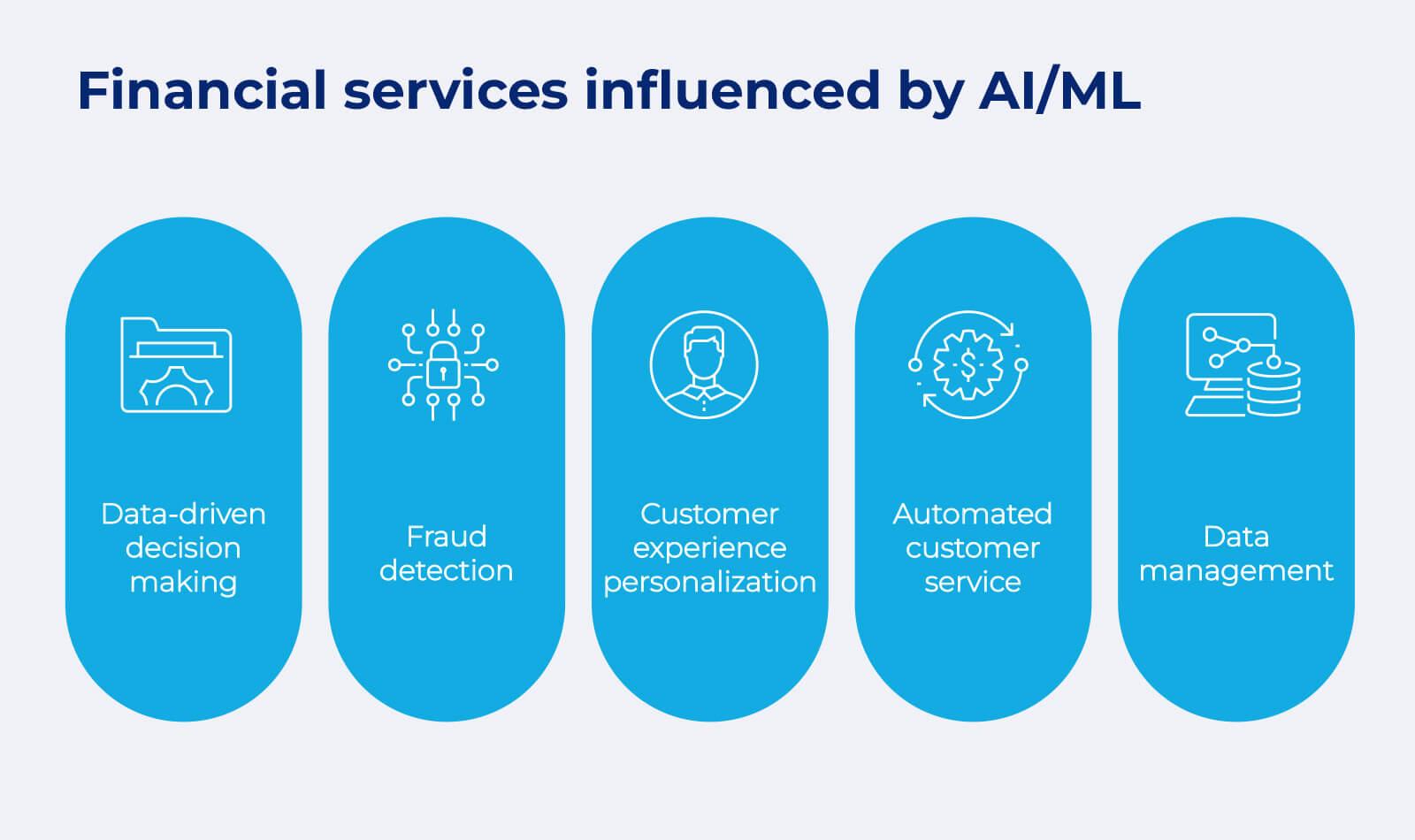

In an age where data flows as freely as currency, the financial services industry stands at a transformative crossroads. Machine learning, a branch of artificial intelligence that enables computers to identify patterns and make decisions with minimal human intervention, is rapidly reshaping how banks, insurers, and investment firms operate.From detecting fraudulent transactions to personalizing wealth management, this technological heartbeat fuels a new era of efficiency and insight. As we delve into the evolving role of machine learning in financial services, we uncover a landscape where algorithms and analytics are not just tools, but vital architects of the future economy.

The Transformative Impact of Machine Learning on Risk Assessment

Advancements in machine learning have revolutionized the way financial institutions approach risk assessment. By leveraging vast amounts of data, algorithms can uncover intricate patterns and correlations that were previously indiscernible to human analysts. This capability enhances predictive accuracy, allowing organizations to anticipate market fluctuations, credit defaults, and fraudulent activities with unprecedented speed and precision.

Key benefits emerging from this change include:

- Dynamic model updating: Continuous learning means risk models evolve with new data, ensuring up-to-date insights.

- Multidimensional data analysis: Integration of alternative data sources such as social media sentiment and transaction histories enriches risk evaluation.

- Reduced operational costs: Automated processes minimize manual intervention, enabling faster decision-making.

| Risk Type | Machine Learning Model | Impact on Assessment |

|---|---|---|

| Credit Risk | Random Forest | increased accuracy in default prediction |

| Market Risk | Neural Networks | Real-time volatility forecasting |

| Fraud Detection | Anomaly Detection | Rapid identification of suspicious transactions |

For a deep dive into the methodologies driving these changes, trusted sources such as CFA Institute and Federal Reserve provide complete research and analysis. Harnessing these innovations fosters a more resilient and adaptive financial ecosystem, enabling institutions to better safeguard assets and optimize portfolio management.

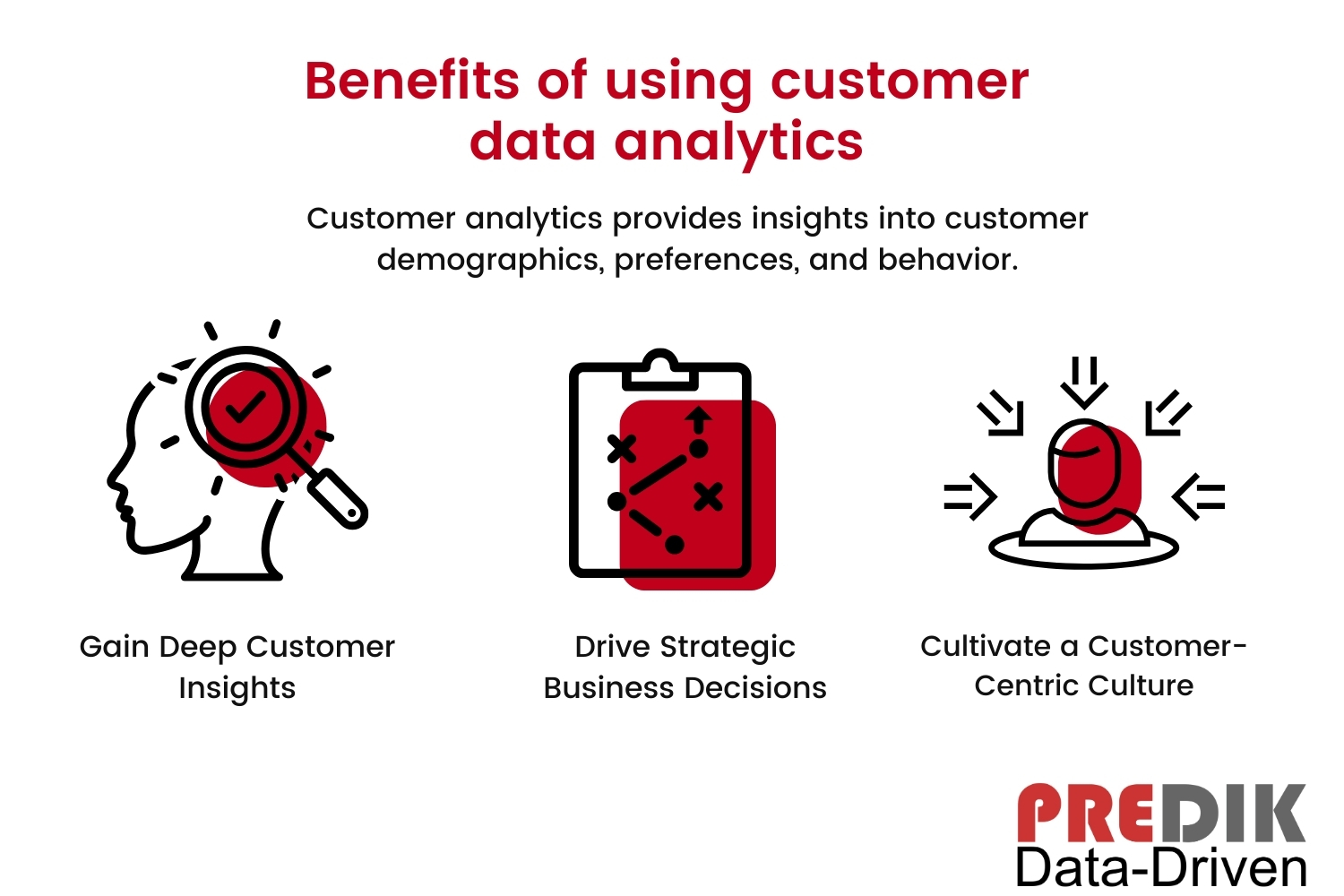

Unlocking Customer Insights through Advanced Data Analytics

Financial institutions are harnessing the power of advanced data analytics to transform raw information into actionable customer intelligence. By leveraging machine learning models, organizations can identify nuanced patterns in customer behavior, enabling personalized services that anticipate individual needs before they arise. This shift from reactive to proactive engagement enhances client satisfaction and drives loyalty, ultimately fostering a competitive edge in an increasingly crowded marketplace.

Key capabilities unlocked through data analytics include:

- Dynamic risk profiling: Continuously updating customer risk scores based on transactional and behavioral data.

- Sentiment analysis: Interpreting customer feedback and social media mentions to gauge brand perception.

- Fraud identification: detecting anomalies with machine learning algorithms to protect both customers and institutions.

| Analytics Dimension | Benefit | Example |

|---|---|---|

| Customer segmentation | Improved targeting | Customized investment plans |

| Behavioral Modeling | Enhanced prediction | Proactive fraud alerts |

| Churn Analysis | Retention strategies | Personalized offers |

For further insights into data-driven financial transformation, explore resources from the McKinsey Financial Services Insights and innovative research at the Harvard Business Review on Financial Services. These platforms provide in-depth analysis on how machine learning continues to reshape customer engagement in the finance sector.

Enhancing Fraud Detection with Predictive Algorithms

Financial institutions are increasingly leveraging predictive algorithms to stay ahead of fraudulent activities. These advanced models analyze vast datasets in real-time, uncovering hidden patterns and subtle anomalies that might otherwise go unnoticed. By continuously learning from new data, machine learning systems adapt to ever-evolving fraud tactics, reducing false positives and improving detection accuracy. This dynamic approach enables proactive risk management, empowering fraud teams to act swiftly and decisively.

Key techniques powering this transformation include:

- Supervised learning to classify transactions as legitimate or suspicious based on historical fraud labels.

- Unsupervised learning for identifying novel fraud schemes without prior examples.

- Anomaly detection algorithms that flag unusual spending behavior or transaction spikes.

| Algorithm Type | Request | Benefit |

|---|---|---|

| Random Forest | Transaction classification | High accuracy and interpretability |

| Autoencoders | Anomaly detection | Effective for outlier identification |

| Neural Networks | Behavioral pattern recognition | Captures complex nonlinear relationships |

To explore foundational concepts and recent breakthroughs in fraud detection, visit authoritative resources such as the National Institute of Standards and Technology (NIST) or Federal reserve’s research division. These insights can definitely help financial services enhance their machine learning frameworks and build more resilient defense systems.

Implementing Ethical AI Practices in Financial Decision making

In the rapidly evolving landscape of financial services, the deployment of AI systems demands a rigorous commitment to ethical standards that safeguard fairness, openness, and accountability. Machine learning models can inadvertently perpetuate biases present in historical data, leading to discriminatory outcomes affecting credit lending, insurance pricing, and wealth management. Financial institutions must adopt robust frameworks that emphasize continuous bias detection and mitigation, ensuring AI-driven decisions enhance inclusivity rather then deepen inequality.

Transparency plays a pivotal role in building trust between financial service providers and their customers. Implementing explainable AI mechanisms allows stakeholders to understand how algorithms arrive at decisions, empowering individuals to contest and audit financial outcomes. this approach aligns with emerging regulatory landscapes, such as the EU GDPR and Federal Reserve guidelines, that prioritize consumer rights and ethical data management.

- Implement rigorous data governance to ensure input data quality and representativeness.

- Engage interdisciplinary teams combining AI engineers, ethicists, and financial experts.

- Maintain ongoing model auditing through real-time monitoring and third-party reviews.

| Ethical Principle | Example in Finance | Benefit |

|---|---|---|

| Fairness | neutral credit scoring algorithms | Reduces discrimination |

| Transparency | Explainable loan approvals | Builds consumer trust |

| Accountability | Clear audit trails | Enables regulatory compliance |

Strategic Recommendations for Integrating Machine Learning in Financial Services

To harness the full potential of machine learning in financial services, firms should adopt a multi-faceted implementation approach that balances innovation with regulatory compliance. Developing a robust data infrastructure is foundational; this includes aggregating high-quality, diverse datasets while ensuring privacy and security standards meet guidelines set by authorities such as the SEC and the FDIC. Integrating machine learning models into existing workflows demands collaboration between data scientists, IT professionals, and compliance officers to create systems that are not only bright but also transparent and auditable.

Key tactical measures to consider include:

- Prioritizing explainable AI to build trust with clients and regulators

- investing in continuous model monitoring and performance validation

- Embedding ethical considerations and bias mitigation strategies into model advancement

- Encouraging upskilling programs to equip staff with machine learning literacy

By adopting these strategies, financial institutions can elevate risk management capabilities, optimize customer interactions, and accelerate decision-making processes with greater accuracy. Below is a simple comparison of traditional versus machine learning-enhanced processes:

| Process | Traditional Approach | ML-Enhanced Approach |

|---|---|---|

| Fraud Detection | Rule-based filters | Adaptive anomaly detection models |

| Credit Scoring | Static scorecards | Dynamic, multi-factor predictive models |

| Customer Service | manual case handling | AI-driven chatbots and sentiment analysis |

For further best practices on AI integration, refer to authoritative insights from the McKinsey Analytics and research on ethical AI frameworks at MIT Technology Review.

The Way Forward

As the financial landscape continues to evolve at a breakneck pace, machine learning stands as both a compass and a catalyst—guiding institutions through vast seas of data while sparking innovations that redefine possibility. From risk assessment to personalized wealth management,its imprint is undeniable,yet the journey is far from complete. Embracing machine learning’s potential with thoughtful oversight and ethical clarity will be key to unlocking a future where technology and finance coalesce not just efficiently,but responsibly. In this unfolding story, machine learning is not merely a tool—it is the quiet architect shaping the next chapter of financial services.